income tax malaysia login

Content Writer 247 Our private AI. Foreign businesses should use the services of established professional services firms to ensure their HR administration is in line with the decree.

Tis The Season To File Your Taxes Again So We Thought We D Help You Out With E Filing Rojakdaily

Engine as all of the big players - But without the insane monthly fees and word limits.

. Freeman Laws The Tax Court in Brief covers every substantive Tax Court opinion providing a weekly brief of its decisions in clear concise prose. This page provides - Sweden Personal Income Tax Rate - actual values historical data forecast chart statistics economic calendar and news. Tool requires no monthly subscription.

There were no changes announced in the income tax slabs both for old and new tax regimes for FY 2022-23 in Union Budget 2022. Overpaid Taxes Can Be Refunded In The Form Of A Tax Return. Will be taxed at a rate of 30 percent plus cess and surcharges.

In addition to the mentioned new income tax thresholds Cambodias government has agreed to increase the minimum wage for the countrys textile garment and footwear TGF industries to US200 per. Tax season will be coming up soon for Malaysians making an income of at least RM34000 for the Year of Assessment YA 2021. This page provides - Finland Personal Income Tax Rate - actual values historical data forecast chart statistics economic calendar and news.

Over 500000 Words Free. If you have any additional tax related questions your best option is to call the IRS directly at free phone 1-800-829-1040. Tax Accounting.

Personal Income Tax Rate in Sweden averaged 5554 percent from 1995 until 2021 reaching an all time high of 6140 percent in 1996 and a record low of 3230 percent in 2020. How To Pay Your Income Tax In Malaysia. With workflows optimized by technology and guided by deep domain expertise we help organizations grow manage and protect their businesses and their clients businesses.

Additional time commitments outside of class including homework will vary by. This page displays a table with actual values consensus figures forecasts statistics and historical data charts for - List of Countries by Personal Income Tax Rate. Personal Income Tax Rate in Denmark averaged 5995 percent from 1995 until 2021 reaching an all time high of 6590 percent in 1997 and a record low of 5540 percent in 2010.

The Income Tax Department NEVER asks for your PIN numbers passwords or similar access information for credit cards banks or other financial accounts through e-mail. Tax Offences And Penalties In Malaysia. If the understatement exceeds the greater of 10 of the tax required to be shown on the return or 5000 10000 for corporations other than S corporations or personal holding companies the penalty applies.

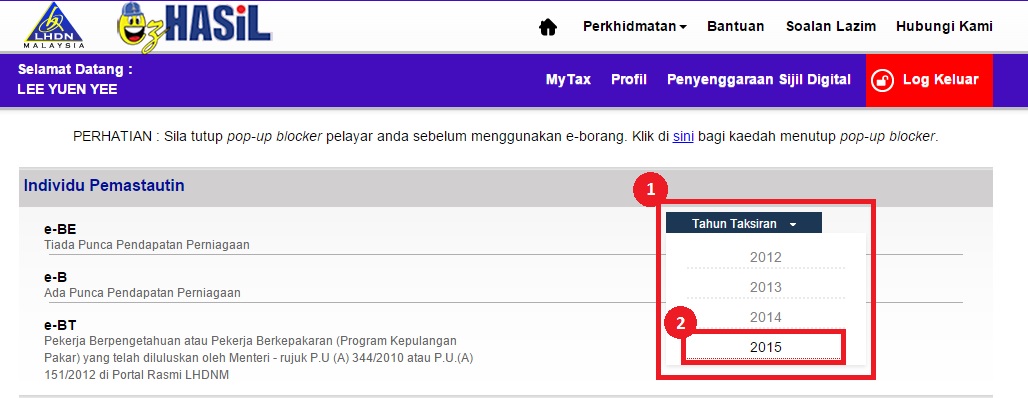

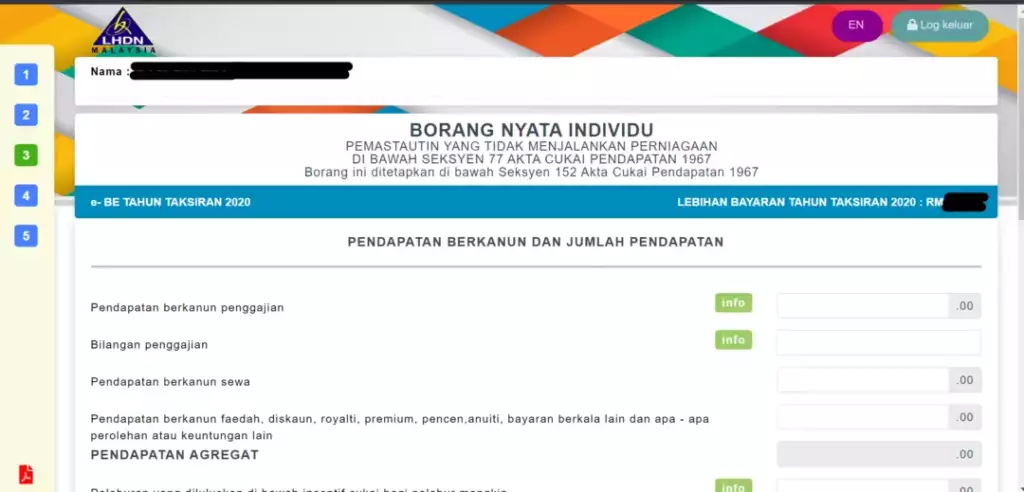

We have mentioned a few here. Guide To Using LHDN e-Filing To File Your Income Tax. Effective from FY 2022-23 gains from various virtual digital assets such as bitcoin dogecoin non-fungible tokens NFTs etc.

However under sections 216 2161 217 and 2183 of the Income Tax Act you have the option of filing a Canadian tax return and paying tax on certain types of Canadian-source income using an alternative tax method. There are 21 offenses under GST. Personal Income Tax Rate in Finland averaged 5352 percent from 1995 until 2020 reaching an all time high of 6220 percent in 1995 and a record low of 49 percent in 2012.

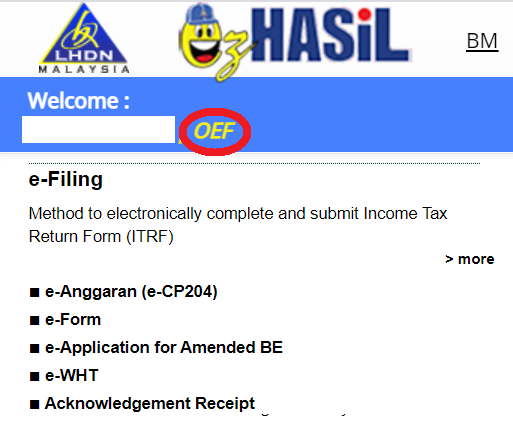

The Income Tax Department appeals to taxpayers NOT to respond to such e-mails and NOT to share information relating to their credit card bank and other financial accounts. The Income Tax Number is allocated by the Inland Revenue Board of Malaysia when you register for tax. Those who have received their Income Tax Return EA Form can do this on the ezHASiL portal by logging in or registering for the first time.

Amendments in tax reliefs have been made this YA 2021 and some new additions have also. In Canada the MAAC applies to Canadian taxes imposed by the Income Tax Act as well as certain taxes imposed under the Excise Tax Act and the Excise Act 2001. Canada became a party to the MAAC on March 1 2014.

The substantial understatement component of the accuracy-related penalty provides for a dollar criteria. The Personal Income Tax Rate in Finland stands at 5695 percent. The Personal Income Tax Rate in Sweden stands at 5290 percent.

Offences Penalties Offences. Lembaga Hasil Dalam Negeri Malaysia abbreviated LHDNM. You can efile income tax return on your income from salary house property capital gains business profession and income from other sources.

How Does Monthly Tax Deduction Work In Malaysia. The Income Tax Department NEVER asks for your PIN numbers passwords or similar access information for credit cards banks or other financial accounts through e-mail. Income tax filing for sole proprietors is straightforward.

You will still be required to login to further manage your account. There are currently more than 140 jurisdictions that are participating in the MAAC. Supporting Documents If you have business income.

S corporation and partnership returns are pass-through returns because S corporations and partnerships usually dont pay income tax at the business level. For a link to our podcast covering the Tax Court in Brief download here or check out other episodes of The Freeman Law Project. To prevent tax evasion and corruption GST has brought in strict provisions for offenders regarding penalties prosecution and arrest.

Instead S corporations and partnerships pass income deductions credits etc to shareholders and partners as reported on the Schedule K-1 information statement. The income tax slabs and rates have been kept unchanged since financial year FY 2020-21. Instead of filing Form BE which is filed by individuals under employment or having non-business income sole proprietors file Form B before 30 June on a yearly basis.

They will be able to provide the best guidance and advice for any tax related questions you may have. List of Countries by Personal Income Tax Rate - provides a table with the latest tax rate figures for several countries including actual values forecasts statistics and historical data. For FY 2021-22 and 2022-23 individual taxpayers will continue to choose between two tax regimes - the existing or old tax regime and the new.

EUPOL COPPS the EU Coordinating Office for Palestinian Police Support mainly through these two sections assists the Palestinian Authority in building its institutions for a future Palestinian state focused on security and justice sector reforms. The Income Tax Course consists of 62 hours of instruction at the federal level 68 hours of instruction in Maryland 80 hours of instruction in California and 81 hours of instruction in Oregon. For the entire list of 21 offenses please go to our main article on offenses.

The major offenses under GST are. This is effected under Palestinian ownership and in accordance with the best European and international standards. The Tax Court in Brief September 26th September 30th 2022.

Your Income Tax Number is a unique reference number that is to be used by you in all dealings with the Inland Revenue Board of Malaysia Malay. By doing so you may receive a refund for some or. The Personal Income Tax Rate in Denmark stands at 5590 percent.

In the process of filing Form B a sole proprietor needs to prepare various information to determine the chargeable. We have also partnered with Sprintax to provide you with expert tax advice please contact them for further assistance. A new section 115BBH has been inserted into the Income-tax Act 1961 for taxation of virtual digital assets.

Just upload your form 16 claim your deductions and get your acknowledgment number online. The Income Tax Department appeals to taxpayers NOT to respond to such e-mails and NOT to share information relating to their credit card bank and other financial accounts. This page provides - Denmark Personal Income Tax Rate - actual values historical data forecast chart statistics economic calendar.

Enabling tax and accounting professionals and businesses of all sizes drive productivity navigate change and deliver better outcomes. Efiling Income Tax ReturnsITR is made easy with Clear platform.

Just An Ordinary Girl How To Do E Filing For Income Tax Return In Malaysia

First Time Taxpayer Registration Guide Income Tax Malaysia 2022 Youtube

Updated 2021 Tax Reliefs For Ya 2020 And How To File Income Tax In Malaysia Using Lhdn E Filing Iproperty Com My

Malaysia Personal Income Tax Guide 2020 Ya 2019

Malaysia Personal Income Tax First Timers E Filing Guide Youtube

Malaysia Personal Income Tax Rates 2013 Tax Updates Budget Business News

Income Tax Non Compliance Of Small And Medium Enterprises In Malaysia Determinants And Tax Compliance Costs Semantic Scholar

How To File Your Income Tax In Malaysia 2022 Ver

Ezhasil E Filing Login Account Pin Number Digital Certificate Application For Organization The Research Files

Malaysia Personal Income Tax Rate 2022 Data 2023 Forecast 2004 2021 Historical

Personal Income Tax E Filing For First Timers In Malaysia

Income Tax Filing In Malaysia Income Tax Filing Taxes Online Taxes

Mwka Online Talk Am I A Tax Resident In Malaysia

How To Check Income Tax Number Malaysia Online

Malaysia Personal Income Tax Rates Table 2012 Tax Updates Budget Business News

Income Tax Rate Comparison Between Malaysian Singaporean R Malaysia

Updated 2021 Tax Reliefs For Ya 2020 And How To File Income Tax In Malaysia Using Lhdn E Filing Iproperty Com My

Withholding Tax On Foreign Service Providers In Malaysia

Lhdn Officially Announced The Deadline For Filing Income Tax In 2021 Attached Is A Guide To Tax Filing Online Everydayonsales Com News

0 Response to "income tax malaysia login"

Post a Comment